YOKOHAMA, Japan (AP) — Osamu Furukawa has driven lots of Japanese cars for his business converting classic gasoline-powered models to electric. But his favorite ride is an import: A battery-powered SUV from China’s BYD Auto.

BYD Auto is part of a wave of Chinese electric car exporters that are starting to compete with Western and Japanese brands in their home markets. They bring fast-developing technology and low prices that Tesla Inc.’s chief financial officer says “are scary.”

Furukawa said he ordered an ATTO 3 when it went on sale Jan. 31, for its user-friendly features and appealing price of 4.4 million yen ($33,000) — or about one-quarter less than a Tesla.

“It’s perfect,” Furukawa said in his office in Yokohama, southwest of Tokyo.

Other ambitious Chinese EV exporters include NIO, Geely Group’s Zeekr and Ora, a unit of SUV maker Great Wall Motors.

Some compete on price. Others emphasize performance and features, putting pressure on Western and Japanese premium brands.

NIO Inc., which has persuaded buyers in China to pay Tesla-level sticker prices of up to 555,000 yuan ($80,000), says its latest SUV goes on sale this year in Europe. The ES6 boasts voice-activated controls and a range of 610 kilometers (380 miles) on a charge.“We are very confident the ES6 will compete in this premium SUV market,” NIO’s founder and CEO, William Li, said in an interview at the Shanghai auto show.

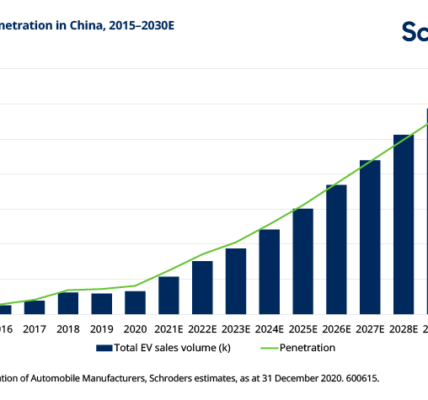

Sales of battery-powered vehicles and gasoline-electric hybrids in China almost doubled last year to 6.9 million vehicles, or half the global total.

That was supported by multibillion-dollar subsidies from the ruling Communist Party, which is trying to make China a creator of clean energy and other technologies. That rattles U.S. and European leaders who see China as a strategic and industrial competitor.

Chinese brands are “serious competition,” according to David Leah, an analyst for GlobalData.

They have “more competitive battery technology” and can “achieve greater economies of scale,” Leah said in an email.

BYD Auto, owned by battery maker BYD Co., edged ahead of Tesla in total 2022 sales at 1.9 million vehicles. Half were gasoline-electric hybrids, while Tesla’s fleet is pure electric.

“We have a lot of respect for the car companies in China,” Tesla CEO Elon Musk said in a Jan. 25 conference call with financial analysts. “They work the hardest and they work the smartest.”