In this article, Ashwin K. Venkitaraman shares his expertise and insights regarding the ongoing challenges of shifting to a more eco-friendly and sustainable mode of transportation in India. Venkitaraman is an automotive engineer with expertise in the EV industry who has been watching this space closely for over 5 years. With the recent transition to use electric vehicles, in a country like India, this discussion is important now more than ever.

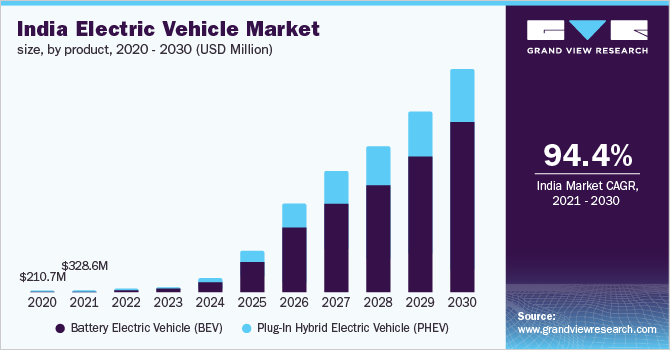

India has set an ambitious target to put 102 million electric vehicles on its roads by as early as 2030. The country of 1.4 billion also hopes to end fossil fuel vehicle sales entirely by then. However, a big part of this goal’s success is hinged on the disproportionate success of EVs in the two- and three-wheeler categories.

Two- and three-wheelers already contribute to nearly 96% of EV sales in 2021. That’s hardly surprising for a country like India, where these vehicles are the preferred modes of transport for last-mile connectivity. And the government appears to have no intention to tinker with what’s already working. In fact, their EV strategy relies heavily on pushing the two-wheeler and three-wheeler EV sales to 80% of the total vehicle sales in this category by 2030! Also, according to this roadmap, 70% of the sales in commercial vehicles would come from EVs, and so do 30% of all private car purchases.

Hurt by the ever-increasing fossil fuel costs, cajoled by attractive government incentives, and convinced by potential cost savings, an increasing number of Indians are choosing to take the EV route. However, as evidenced by the above numbers, their purchases tend to be in the two-wheeler category. Why?

The reason is range anxiety. EV users use their vehicles almost exclusively for intra city commute, rarely for long distances. The source of their range anxiety is the virtual absence of an EV charging infrastructure across the length and breadth of the country.

Current State of EV charging infrastructure in India

The Government of India launched FAME1 (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) & FAME 2 initiatives to spur the establishment of EV charging points across India. As part of these two programs, 3,397 charging stations have been sanctioned. However, since the launch of FAME 1 in 2015, less than 2,000 EV chargers have been operationalized. Of these, at least 678 public charging stations have been installed between October 2021 and January 2022. That’s to say that the pace of EV charging infrastructure development has picked up in recent months.

Interestingly, the government is roping private players, PSUs, and even start-ups to give impetus to its EV charging infrastructure plans. Buoyed by the response of private players to its outreach, the government hopes to take the number of operational public EV chargers to 7,000 within the next 18 months. Despite the positive growth, India is still far from the estimated 46,000 EV charging stations required to sustain its targeted 102 million EVs on the road by 2030.

The road ahead is not a smooth one. Challenges abound.

Challenges to EV Charging Infrastructure Setup

A multitude of challenges continues to hinder the development of EV charging infrastructure. Here are some of them:

1. EV Charging is Ruled by Factions

There are 3 different levels of EV chargers and 9 different types of charging connectors used by different EV manufacturers and charging stations. Some are compatible with each other; some can be used with adapters on other EVs. Groups of manufacturers have been trying to push their standards on different countries in a bid to “win” against the competition. Although the EU is mulling over the possibility of standardizing EV charging technologies, India is far from such a decision.

2. High Initial Investment

Access to power, sufficient land area, EV technology purchases, prime location setup, and various other reasons escalate the cost of setting up a public EV charger. A possible solution is to set up both fast and slow chargers, complemented by all types of connectors from different manufacturers. This way, the utilization of EV charging infrastructure increases, ultimately making it profitable for investors.

3. Support Infrastructure

Unlike fossil fuels, which can be easily handled, electricity for EV charging comes with safety challenges. An estimated 17,634 people die in India annually due to electrocution. For efficiency, EV charging stations should use DC power, which is more hazardous than AC. To counter the increased risk posed by DC power, stabilizers, proximity sensors, control pilot sensors, and other technology would be needed, which can increase the setup cost even more.

4. Accessibility

Despite concerted efforts by private players and the Government of India, the density of EV stations is low, even in metro cities. So, EV users have trouble finding the charging stations closest to them.

5. Political Will

Although the central government has made EV adoption and EV charging infrastructure a high priority, the state governments have displayed varying degrees of interest in its vision. They are all charting their own paths to an EV future.

How Governments are Overcoming the EV Charging Infrastructure Challenges

The various state governments and the central government in India are leveraging every resource, every assistance, and every piece of technology available at their disposal to rapidly improve the penetration of EV charging infrastructure across the country.

As part of FAME 2, the central government has allocated INR 10 billion to subsidize and promote the setup of 2,877 EV charging stations. The GST on EV chargers has been reduced from 18% to 5%. All EV charging stations are now allowed to source power from any utility company at the same rate, which brings transparency and predictability in terms of costs. On top of it, Bharat Charger and BIS Working groups are taking the initiative of EV charging technology standardization.

Kicking it up a notch, the government has removed the requirement of obtaining a license for setting up EV charging stations. Even residential establishments can set up EV charging stations for private and commercial purposes. In an incredible move, the government has now allowed people to buy EVs without batteries so that consumers can use battery swapping services to power their vehicles. Since batteries cost as much as 50% of the vehicle’s value, this move can spur a new wave of EV purchases.

Some state governments, to their credit, are taking their own initiatives to fuel EV adoption, and setting up a reliable EV charging infrastructure is critical to the success of their plans. Delhi, for instance, is offering reimbursements on state GST, subsidies for EVs and EV charging stations, and other benefits to attract investments. Interestingly, Delhi is relying on battery swapping services to realize its EV goals. Encouraged by such decisions, BPCL, Honda, and Reliance have expressed interest in entering the battery swapping domain this year.

Private Players are Coming Up With Solutions Too

Not to be left behind, private players are taking an increasing leadership role in setting up EV charging infrastructure. Tata Power has developed an overarching vision for an electric India and is actively promoting it. The company has singlehanded installed over 2,200 charging points in the country, with 1400 more in the pipeline. It aims to add another 21,000 home chargers and 240 bus charges to its existing network soon. The EZ Charge app, developed by Tata Power, helps EV users locate charging stations closest to them, plan their route, charge, and make online payments.

Another EV charging services provider, Fortum, is also offering customers a flurry of EV charging solutions, including a cutting-edge app with functionalities similar to EZ Charge.

Likewise, Siemens and Ola have partnered to develop e-mobility solutions of their own, even as Siemens hopes to fulfil the various state governments’ demands for cost-effective and reliable solutions for EV charging infrastructure.

What’s Next?

So far, the developments in EV charging space in India have centred around developing individual charging stations across the country. Although commendable, it’s a piecemeal strategy with limited potential. If the country intends to realise its EV goals for 2030, it must dream big and act big. Community parking areas, commercial building parking areas, and even street light poles can be turned into EV charging stations. Largescale parking spaces can be turned into solar-powered EV charging stations. Level 3 chargers must become the mainstay of EV charging if it’s to be accepted by the broader public.

These developments require a national strategy, coordination between various stakeholders, and strong political will. Only time will tell whether they come together in time.