General Motors is slashing the prices of its Cadillac Lyriq by almost 14% amid heightening competition in China’s EV market. The move comes days after Volkswagen introduced a “historical low price” offer on its ID.3 electric car.

According to the company’s website and social media, the Cadillac Lyriq now starts at 379,700 yuan ($52,443), down 13.65% from its previous price of 439,700 yuan ($60,730).

Cadillac launched pre-orders of the all-electric Lyriq luxury SUV in China last November with a starting price of 479,900. Deliveries began just before the end of the year. Lyriq prices are down over 20% from when it was launched under eight months ago.

Based on GM’s Ultium platform, the Cadillac Lyriq has 608 km (377 m) CLTC range. The SUV produces up to 375 kW (502 hp) and 710 Nm max torque powered by two electric motors.

The inside features GM’s latest Virtual Cockpit System with 33.8-inch infotainment. The Lyriq stays true to Cadillac’s luxury roots with premium massaging front seats, a crystal electric control knob, a panoramic glass dome, and a 19-speaker studio-grade sound system.

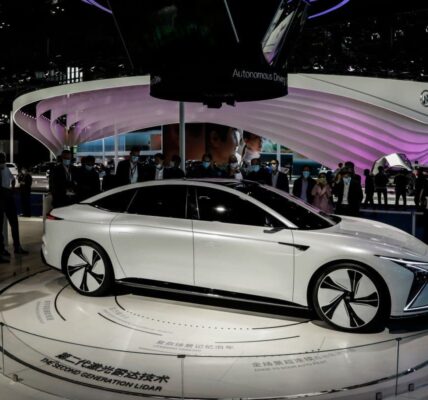

Cadillac cuts Lyriq prices in China amid EV competition

GM’s Cadillac Lyriq price drop comes just days after Volkswagen revealed a limited-time offer on its smallest electric car, the ID.3.

Volkswagen’s ID.3 deal starts at 125,900 (roughly $17,500), down over $5,000 from its original prices, according to the company’s JV SAIC-VW.

After dominating the market, the German automaker watched overall sales fall 3.6% last year as the market transitions to pure EVs. Volkswagen sold just over 11.3K EVs in China in May, representing 2.9% of the market, down from 3.2% last year.

Volkswagen is facing intensifying pressure from shareholders regarding the China market. At the automaker’s general meeting in May, Shareholders brought up the increasing competition from Tesla and BYD.

CEO of Volkswagen Group, Oliver Blume, acknowledged the market in China was rapidly transitioning toward electric, highlighting its plans to remain competitive. Blume says the company will create EVs designed for buyers in China by working with local partners to win back market share.

Electrek’s Take

Domestic automakers like BYD and EV makers like Tesla continue to take their share of the Chinese auto market.

With the BYD starting at 116,800 yuan ($16,100) and the Yuan Plus starting at 134,000 yuan ($18,500), foreign automakers like Volkswagen and GM are having difficulty competing on price.

Meanwhile, the premium market is also gaining competition with Tesla and other domestic EV makers like NIO, taking from the luxury market. BYD sold nearly 30K Dolphin electric cars in May alone, about 11 times the ID.3.

In comparison, GM sold just over 900 Cadillac Lyriq models in the first three months of the year. Back in the US, GM is struggling with battery production as it works to bring its four Ultium battery cell plants online.

GM sold 1,348 Lyriq EVs in the US in the second quarter, up from 968 in Q1. Hummer EV sales fell 83% from last year, with only 47 sold in the second quarter. The Bolt EV and EUV continued carrying GM’s sales with 13,959 of the 15,652 EVs sold in Q2.