Moving beyond electric vehicles themselves, blank-check companies are targeting battery developers critical to the growing demand for zero-emission commercial vehicles.

The most attractive battery-making companies have track records and significant revenue, reducing the risk to investors. The special purpose acquisition companies (SPACs) sponsoring their public debuts promise hundreds of millions of dollars for rapid scaling of the businesses.

Romeo Power Inc., founded in 2015 by expatriates of Tesla, SpaceX, Amazon and Samsung. Romeo completed a business combination with RMG Acquisition Corp. on Dec. 28. It has $545 million in contracted orders and a customer base representing 68% of North American Class 8 truck manufacturers.

The $394 million that Romeo received at the closing of its reverse merger will fund the chase of European and Asian customers while adding contracts in North America, CEO Lionel Selwood told FreightWaves in an interview.

Proterra Inc., a maker of heavy-duty electric transit buses, drivetrains, batteries and charging systems. Its reverse merger with ArcLight Clean Transportation Corp. will bring $648 million in cash and a $1.6 billion valuation to Proterra when the business combination is completed. Proterra’s order book: $750 million.

Proterra recently cut a deal with Japanese construction giant Komatsu to build a proof-of-concept electric excavator this year. Commercial production would follow in 2023 to 2024 using high-energy density and fast-charging technology.

An early investor in Proterra, Daimler Trucks uses Proterra batteries in its Thomas Built Buses subsidiary.

Recently, 15-year-old battery maker Microvast Inc. made official an expected SPAC sponsorship by Tuscan Holdings Corp. in a deal valued at $3 billion.

Tuscan raised $276 million in a March 2019 initial public offering. It added $540 million from investors including defense contractor and heavy equipment maker Oshkosh Truck Corp. and Black Rock. The world’s largest asset management company frequently purchases private investment in public equity (PIPE) shares.

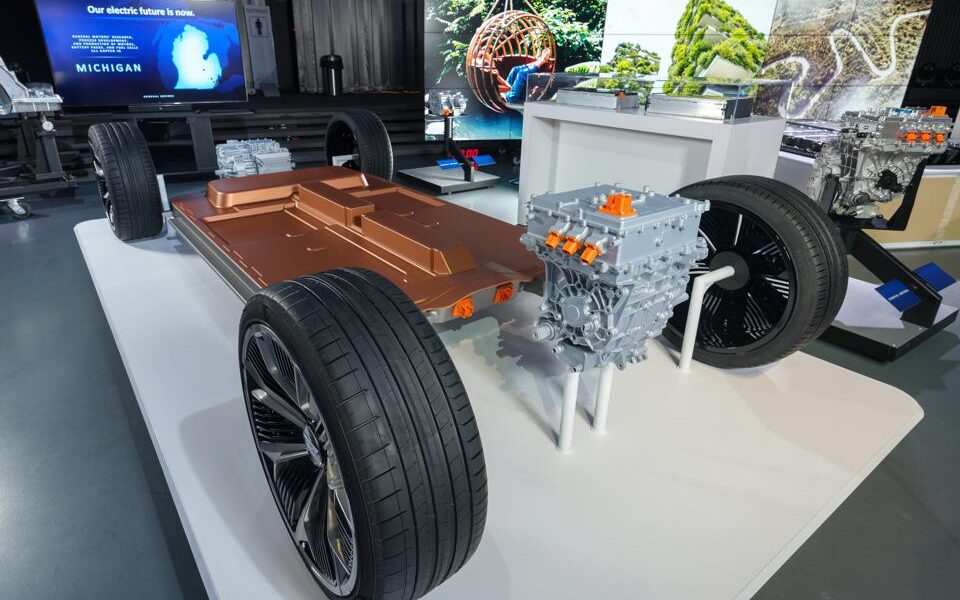

Microvast is focusing on commercial vehicles like port equipment and mining trucks because, as CEO Yang Wu told Bloomberg, passenger vehicle companies will make their own batteries. One example is General Motors Co., which is building a plant in northeast Ohio for its $2.3 billion joint venture with cell maker LG Chem to assemble Ultium battery packs.

Romeo claims its battery packs deliver an average of 30% greater power density than competitors. In some applications, Romeo packs hold twice as much energy. That is critical to reducing the on-board mass of batteries needed to deliver long-haul range comparable to diesel-powered trucks.

“Depending on the state of charge, we can charge large-scale capacity batteries in 30 minutes or less today,” Selwood said. “We are driving toward being able to charge large-scale commercial vehicle batteries in 15 minutes or less in the future.

“Today, we’re enabling more than 300 miles on a single charge with our largest single-capacity batteries,” he said. “We are heads down trying to get to 500 miles on a single charge in the future. We’re the market leader. But I’m not happy. We need to get to 500 [miles].”

A single charge covering 500 miles and a 15-minute recharge time would put battery power on par with diesel. With less maintenance required, the total cost of ownership could be less. Romeo has evaluated more than 200 cell technologies.

“What that has allowed us to do is not only understand battery cells at the raw materials chemistry levels,” Selwood said. “It is allowing us to drive the development of the up-and-coming battery cell providers that nobody is really talking about.”

The big names in battery cells have multiple partners and big dreams. LG is working with GM; Panasonic provides cells for electric vehicle leader Tesla Inc. and China-based CATL sells batteries to Daimler Trucks. Samsung is working on a solid-state battery with a 500-mile range.

Even before it became a SPAC target, Romeo built sustainable relationships to grow its business.

BorgWarner Inc. formed a joint venture and invested $50 million for a 20% stake in Romeo in May 2019.

“We believe our global engineering and manufacturing footprint enables us to quickly commercialize cutting-edge technology,” Joel Wiegert, president of BorgWarner Morse Systems, said when the joint venture was formed. Wiegert is now CEO of engine drive systems maker Dayco Products.

“We were able to bring the leading-edge battery technology that kind of completes the [BorgWarner] portfolio,” Selwood said.

Romeo also counts waste hauler Republic Services Group among investors and partners. It signed a deal last week to retrofit two Republic trucks. Republic canceled a deal in December to buy 2,500 electric refuse haulers from startup electric truck maker Nikola Corp. Coincidentally, Nikola is also a Romeo customer.

“We believe our partnership with Romeo Power will strengthen our leadership position within our industry in both electrification and sustainability,” Republic Chief Operating Officer Tim Stuart said. He joined Romeo’s board of directors in November when it bought additional shares in Romeo’s SPAC sponsor.

Republic continues demonstration projects for electric refuse trucks with Mack Trucks and Peterbilt Motors.

Romeo nearly doubled the size of its order book in November when it signed a five-year production contract with Canada’s Lion Electric Co. Romeo expects to book $234 million in revenue from equipping Lion’s Class 6-8 commercial trucks and buses. The company recently expanded its 113,000-square-foot manufacturing facility in Los Angeles.

In January, Romeo signed a deal with Heritage Environmental Services that should lead to fleet sales of 500 electric trucks by 2025, with a long-term goal of electrifying 2,000 trucks.

“We’ve been proving our technology and putting it into the hands of customers, and that is translating to long-term agreements,” Selwood said. “That’s why you invest in Romeo versus just purchasing. The uptime and profit per mile and [return on investment] are what matters.”