China’s electric vehicle (EV) market is set to lose steam in 2023 as Beijing phases out cash subsidies and consumers shy away from big-ticket items over concerns about a gloomy economy.

Slow sales growth of battery-powered vehicles could exacerbate production overcapacity woes facing the mainland’s automotive industry, which employs one out of every six people in China’s workforce of 800 million.

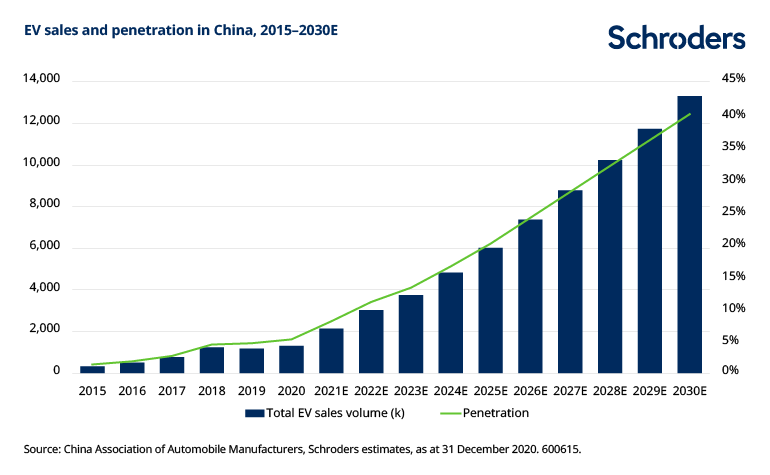

According to the China Passenger Car Association (CPCA), the mainland’s 200 or so electric-car makers are expected to deliver a total of 8.4 million vehicles in 2023, up about 30 per cent from this year’s 6.4 million units.

However, that growth rate is in stark contrast to the year-on-year growth of 114 per cent recorded in 2022. China’s EV industry sold 2.99 million vehicles in 2021.

“Drastic efforts must be made by [authorities and companies] to create jobs and improve employees’ incomes so that more vehicles can be sold in 2023,” said Cui Dongshu, general secretary of the CPCA. “We would also like to lobby taxation authorities to grant more incentives to bolster car purchases.”

From January 1, Beijing will phase out cash subsidies for EV purchases, ending 12 years of efforts to encourage sales of the environmentally-friendly vehicles.

In 2022, the central government granted a subsidy of 12,600 yuan (US$1,826) to buyers of electric cars with a driving range of more than 400 kilometres.

“The EV market hinges on the economic and business outlook,” said Ding Haifeng, a consultant at Shanghai-based financial advisory firm Integrity. “Most middle-class consumers are not confident that their earnings will rise in 2023. They will be cautious in making decisions on car buying.”

China’s abrupt decision in December to shift from its strict zero-Covid policy to one of living with the coronavirus resulted in a surge of infections across the mainland, which has disrupted activity in multiple industry sectors, including EVs.

Industry officials predict that production and sales of EVs could return to normal in May or June, after the current Covid outbreak eases.

China’s goal of achieving carbon neutrality by 2060 has been a major driving force for the nation’s EV market as a rapid expansion of charging infrastructure made it increasingly convenient for owners of battery-powered vehicles to travel between cities and villages.

In November, 36 per cent of new vehicles taking to the mainland roads were either pure electric or plug-in hybrid cars.

Swiss bank UBS has predicted that by 2030, three out of every five new vehicles sold in China will be powered by batteries.

But the rosy outlook is not enough to keep every business afloat.

A research report by CCID Consulting found that in 2020 the mainland had annual capacity of 26.7 million electric cars, which was four times the national EV output in 2022.

“Excess capacity remains a thorny issue for the mainland’s EV industry to overcome,” said Gao Shen, an independent analyst in Shanghai. “Competition will become fiercer in 2023 as more new models hit the market.”

Dozens of new models from tech giants such as Baidu and smart EV builders Xpeng and Nio will be delivered to customers in the coming year.

In the premium EV segment, Tesla, the runaway leader in the Chinese market, plans to operate a reduced production schedule at its Shanghai plant in January in response to slower demand for its Model 3 and Model Y vehicles.

Tesla will produce cars for only 17 days in January – between January 3 and 19 – then will halt output for the rest of the month as part of an extended break for Chinese New Year, Reuters reported.

Nio, Xpeng and Li Auto, the three carmakers seen as Tesla’s main rivals in China, reported a big jump in deliveries in December as drivers rushed to complete purchases before the cash subsidy ended.

Nio delivered 15,815 units, up 11.6 per cent from November. Its annual deliveries rose 34 per cent year on year to 122,486 units.

Li Auto saw deliveries in the month climb 41.2 per cent to 21,233 units, bringing the total number for 2022 to 133,246, up 47.2 per cent from a year earlier.

Xpeng’s deliveries last month surged 94 per cent to 11,292 units. In 2022, it delivered a total 120,757 vehicles, a 23 per cent year on year increase.

Concerns about job losses and lower wages have forced some buyers to cancel orders for premium electric cars, instead turning to mass market vehicles in what dealers describe as a “consumption downgrade.”

“A rising number of consumers are taking a rational stance on purchases of electric cars,” said Guan Mingyu, a partner with global consultancy McKinsey. “They are more price sensitive and would like to chase value-for-money EVs.”