Will Trump’s Duties On China-Made Rechargeable Batteries Cause Drones, Phones, Toys and Electric Cars To Run Out Of Power?

American manufacturers of rechargeable electronic devices will be scrambling with a dilemma starting Monday: pass a 15 per cent import duty on China-made batteries to customers, or find alternative sources from China to power their smartphones, drones, or electric vehicles.

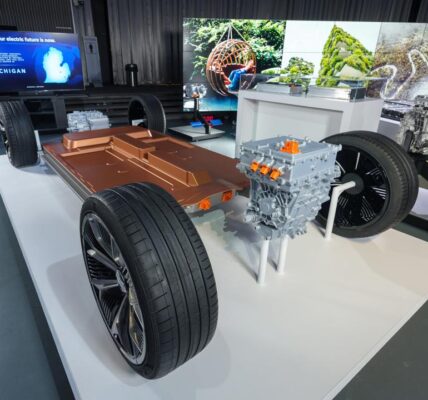

These batteries, used in rechargeable products from personal computers to shavers are mostly made in China, the largest exporter of lithium-ion cells to the US for the past seven years. Chinese producers made up US$872.8 million, or more than half of all lithium-ion batteries imported by the US in the first six months of this year.The latest tariff is among the whiplash of mixed messages by US President Donald Trump, who switched from calling Chinese President Xi Jinping an “enemy” on Friday to “a brilliant man” on Monday, before saying China wants “to be able to make a deal” to end the year-long US-China trade war. For America’s US$950 million energy storage industry, more than 70,000 jobs are at stake, making it one of the country’s fastest-growing sectors, expected to triple to US$2.5 billion by 2020.

“Imposition of duties on key components required for the US energy storage industry would constitute a major – and a completely unnecessary – step backwards in achieving the US energy policy goal of a more secure grid for all Americans,” Kelly Speakes-Backman, the chief executive of the Energy Storage Association (ESA) said in a June 17 letter to the office of the US Trade Representative (USTR) objecting to the tariffs.

Tariffs on Chinese-made lithium-ion batteries “will raise costs to utilities and electric customers using battery storage for electric system modernisation and resilience” as the batteries are not available from US suppliers to a “meaningful degree,” said the ESA, a trade group of companies working to modernise the American electric grid.Trump is using tariffs as a weapon to force Beijing to change decades of trade and industrial policy, but concerns are rising the escalating trade war could send the US economy into a recession.SUBSCRIBE TO HK BUSINESS BRIEFINGGet updates direct to your inboxSUBMITBy registering, you agree to our T&C and Privacy Policy

The Congressional Budget Office said on August 21 that the US budget deficit could surpass US$1 trillion in financial year 2020 as government revenue is growing at a slower pace than expected, in part because of “increases in tariffs, greater uncertainty about trade policy, and slower economic growth in the rest of the world”.

The tariff could put Impossible Aerospace, a California maker of drones for police and first responders, at a severe disadvantage to its Chinese counterparts.

The Santa Clara start-up lobbied the Trump administration earlier this summer to remove a variety of components vital to its unstaffed aircraft from the latest tranche of proposed tariffs, including printed circuits, carbon fibres and magnets.

Most of those import categories are excluded from the next round of tariffs, but lithium-ion batteries remain on the list. Unlike batteries, completed drones are not subject to additional duties under the proposed tariffs.

“This puts American manufacturers at a competitive disadvantage; to build the exact same product using American workers, we must pay more in tariffs than our competitors do to import a completed aircraft from China,” Stephen Gore, Impossible Aerospace’s chief executive, said in a June 11 letter.

Finding an alternative battery supplier has been difficult for many companies given mainland China’s dominance over much of the global supply chain.

Panasonic Corporation, the Japanese consumer products maker, said it has invested heavily in the production of lithium-ion battery production at Tesla’s Gigafactory in Reno, Nevada, but those batteries are currently being made exclusively for Tesla vehicles.

“We are pushed by cost constraints and by limited global production to source from China as it is the only available source for certain lithium-ion batteries to supply the US market,” Panasonic said in a June letter. “Until this battery production grows here in the US or elsewhere, Chinese imports of lithium-ion batteries remain the sole available source.”

Duties on batteries would have a “very real negative impact on hundreds of people employed by my business,” said Steve Fludder, CEO of Massachusetts energy storage system maker NEC Energy Solutions.

“The administration itself has recently extolled the virtues of energy storage systems whose benefits have also received significant media coverage,” Fludder testified at a June hearing in Washington.

“Communities in California, Oklahoma, Texas, Florida, Massachusetts and elsewhere all stand to gain if growth in energy storage continues at current projections,” he said. “If additional duties on batteries and containers render energy storage less economical, the gains currently being realised may slow, if not grind to a halt.”

Since June, the Trump administration has removed specialised containers used by the industry for residential energy storage, but not the batteries themselves.

Enel Green Power North America, part of Italy’s Enel, said it may be forced to shelve a US$200 million investment plan because of the higher costs. The company has operating renewable energy plants and projects under development in 24 US states and two Canadian provinces.

“The uncertainty of the broader economic impact of these tariffs has made our customers uncomfortable to investment and unwilling to close deals,” Jack Thirolf, associate vice-president, regulatory and institutional affairs at Enel Green Power North America, said in a June 17 letter.This article appeared in the South China Morning Post print edition as: u.s. producers cry foul over tariffs on china-made lithium-ion batteries