Half of all vehicles sold in China in July were either new pure electric vehicles (EV) or plug-in hybrids, industry data showed, a milestone that underscores how far the world’s biggest auto market has leapt ahead of Western counterparts in EV adoption.

Sales of so-called new energy vehicles (NEVs) jumped 37% last month from the same period a year earlier, accounting for arecord 50.7% of car sales, data from the China Passenger Car Association showed.

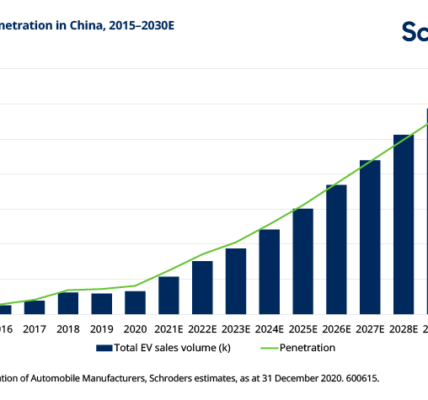

NEV sales accounted for just 7% of total vehicle sales in China three years ago, but its heavy investments in EV supply chains have propelled the growth of domestic EV industry, leaving many established foreign brands scrambling to catch up.

By contrast, the share of electric and hybrid vehicle sales in the United States amounted to 18% in the first quarter of this year, according to the US Energy InformationAdministration, a research firm.

The pace of growth for NEVs in China accelerated from a28.6% surge in June. Sales of pure electric vehicles climbed14.3% in July, up from 9.9% growth for June.

Solid growth in NEV sales helped some local brands includingBYD and Li Auto set freshmonthly sales records in July.

But overall domestic car sales fell 3.1%, extending declinesfor a fourth straight month with consumer confidence weak as theeconomy struggles to gain momentum amid a prolonged crisis inthe property market.

Weakness in the auto market prompted China’s state planningagency to announce in late July that cash subsidies for vehiclepurchases would be doubled-up to $2,785 per purchase-and would be retroactive to April when the subsidieswere first introduced.

China’s top EV firm BYD continued to offer discounts inJuly, but in a less intensive manner than in the first half. Itoffered a price reduction of up to 17.3% on the hybrid SUV BAO 5under its off-road Fangchengbao lineup at the end-July.

Vehicle exports in July rose 20% year on year, easing from an 28% increase in June.