One of China’s top battery-makers believes it has cracked a technology to provide even cheaper and more powerful packs for electric vehicles.

Gotion High-Tech recently unveiled a lithium-manganese-iron-phosphate battery – LMFP for short – which it says will power an EV for 621 miles on each charge. Until now, it’s been largely the more expensive nickel-cobalt batteries that have provided that kind of range.

“It’s an upgrade; it’s a leap for energy density,” Cheng Qian, executive president of Gotion’s international business unit, said in a phone interview from Tokyo.

Gov. Gretchen Whitmer and Michigan Economic Development Corporation CEO Quentin Messer, Jr., announced in October a state incentive package approved by the Michigan Strategic Fund to bring Gotion to Big Rapids. The state House and Senate also approved the incentives.

Gotion’s $2.364 billion investment in Michigan will create up to 2,350 new jobs in Big Rapids and the surrounding area and serve increasing demand in the battery production industry. Gotion chose Michigan over potential sites in Texas, Georgia, Kentucky, South Carolina, Illinois and Ohio.

The proposed Gotion battery plant has been met with some community pushback – notably from Congressman John Moolenaar, whose district includes western Midland County.

“To take millions of dollars from Michigan taxpayers and give it to a subsidiary of a company that pledges allegiance to the Chinese Communist Party is a historic mistake by the Michigan legislature,” he stated in an April press release. “This proposed facility will be 100 miles from Camp Grayling, where the Michigan National Guard has trained military partners from Taiwan to prepare for possible CCP aggression. Yet, Michigan’s state government leaders are siding with CCP-affiliated companies.”

State Sen. Kristen McDonald Rivet said there was “a huge amount of misinformation” spread about the proposed Big Rapids plant. She specifically noted that Gotion – widely referred to as a Chinese company by critics like Moolenaar – has a majority stakeholder in Germany, but does have ties to China.

“There are many companies in this state that have ties to the Chinese government,” McDonald Rivet said. “I was satisfied to vote yes for a couple of reasons. It creates jobs in a region that desperately needs them, it was thoroughly vetted from a security perspective by the federal government, it has done its environment due diligence, and I was inundated with calls from local residents asking me to vote yes.”

Gotion, listed in Shenzhen and with Volkswagen as its largest shareholder, expects its LMFP battery to cost 5% less than a conventional LFP battery in terms of dollars per kilowatt hour, Cheng said. That would be as much as 20% to 25% cheaper than nickel-cobalt units.

Gotion’s offering adds manganese to existing lithium-iron-phosphate chemistry that was commercialized in China and has been adopted by major EV makers from BYD to Tesla as a method of cutting the cost of some models. Improvements in LFP that pack more power into smaller packages have helped popularize the technology, which is typically cheaper to manufacture.

LFP batteries almost hit a ceiling of energy density at 190 Wh/kg, Cheng said, while Gotion’s new battery could achieve 240 Wh/kg. That means it can store more energy in every battery cell, minimizing the weight and size of the pack.

The innovation highlights how battery technology and raw material needs are still evolving and unpredictable as the world’s automakers seek to slash costs while boosting EV performance. It also shows how Chinese companies continue to pioneer those advances.

The LMFP chemistry can replace some of the industry’s nickel-cobalt cells “with the same performance but lower costs and better safety,” Cheng said. “I think it’s very attractive for carmakers, and I have to say a lot of companies will follow this trend.”

LMFP technology is not new, but traditionally the cells are not used in EV applications for reasons from low conductivity to high-temperature dissolution or low density. Gotion said its battery – which it calls “Astroinno” – has overcome those technical challenges.

Gotion’s manganese-added cells “will create real opportunity to compete with some NCM chemistries where standard LFP struggles to compete on energy density,” said Victoria Hugill, battery research analyst at London-based consultancy Rho Motion. LMFP could take a 6% market share by 2040, likely surpassing other emerging options like sodium-ion batteries, she said.

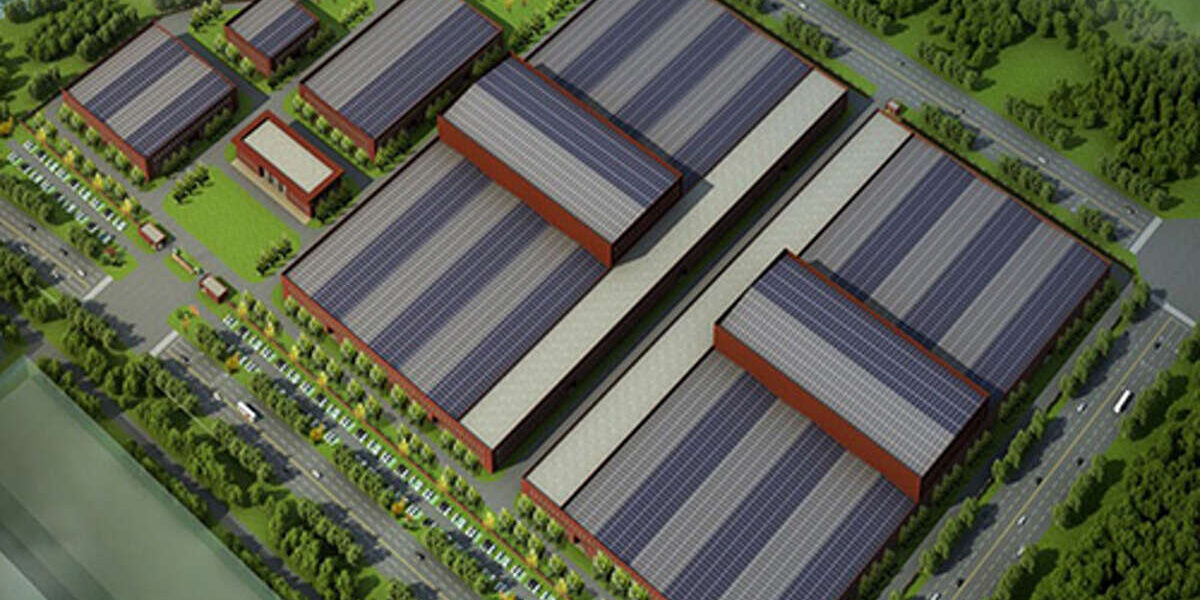

Astroinno could be in mass production as soon as the second quarter next year, according to Cheng. It has passed safety tests and the LMFP batteries will be manufactured in two plants in China’s Anhui province.

Gotion has been ramping up overseas expansions, from planning the Big Rapids plant to raising a global depositary receipts offering in Switzerland last year. The company was the world’s eighth-largest battery manufacturer last year, according to SNE Research.

Astroinno joins some other significant battery innovations by Chinese companies in recent years. In 2020, BYD launched its Blade battery – an LFP unit with sleeker shape and improved energy density. Contemporary Amperex Technology is developing what it calls a condensed-state battery.

Among advantages will be an ability for fast charging that could take just a shade more than a quarter of an hour, according to Gotion’s Cheng.