FAW is China’s third largest carmaker, and counts Hongqi – or Red Flag – limousines for China’s communist party leaders among its products.

It has been trying to gain ground in the world’s largest electric car market against domestic competitors like Geely and SAIC.

The new joint-venture factory will build fully-electric Audi models.

The $4.6bn facility is set to open in 2024 in Chungchun in China’s Northeast, according to Audi.

“This deepened partnership between Audi and FAW heralds a new era of electrification as the next ‘golden decade’ for Audi on the important Chinese market,” said President of Audi China Werner Eichhorn, in a press release.

China is the single biggest market in the world for Audi, which sold more than 700,000 vehicles there in 2020.

The German luxury brand wants electric vehicles to make up one-third of its sales in China by 2025.

Audi and its owner Volkswagen will own a 60% stake in the joint venture, while FAW will own 40%.

FAW already produces Audi models locally and has a longstanding relationship with Audi and its parent company Volkswagen.

The company was created as part of an industrialisation push by Chinese Communist Party Chairman Mao Zedong in the 1950s.

Its premium Hongqi models, which were originally created to transport diplomats and communist party officials, fell out of favour in the 1980s before being revived amid a national push to promote Chinese brands.

China’s President Xi Jinping rode in a Hongqi limousine during a military parade to commemorate the 70th anniversary of the end of World War II in 2015.

FAW sold more than 3 million units in 2020, including 200,000 of its premium Hongqi branded cars.

The company plans to electrify most of its Hongqi models by 2025.

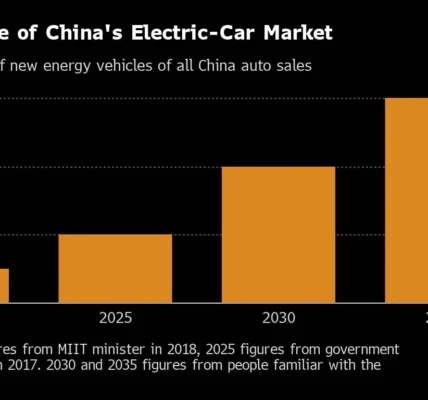

Audi’s latest move comes amid a backdrop of increasing competition in China’s electric car market.

According to the International Energy Agency, there were 7.2 million electric cars on the road globally by 2019, with 47% of them in China.

China’s electric vehicle sales are tipped to reach 1.8 million units this year, according to the China Association of Automobile Manufacturers.

The FAW-Audi tie up will likely compete with BMW, which has its own electric vehicle joint-venture with Chinese sports utility vehicle maker Great Wall Motors.

Tesla is also a major player, with its first Chinese-made electric vehicles rolling off the assembly line of the car maker’s Shanghai gigafactory last year.

A number of local start-ups, like Nio, Aiways, XPeng, Li Auto and WM Motor are also vying for a slice of the Chinese market.

Increasingly, local electric car markers have also been looking to incorporate high tech features into their cars in an effort to become more competitive.

Many have partnered with China’s big technology companies to manufacture smarter electric vehicles.

Chinese media have reported that Alibaba and SAIC will work together under a new premium electric vehicle brand called Zhiji, which will feature new battery technology that will extend the car’s range.

Chinese search engine Baidu and iPhone maker Foxconn have also each announced partnerships with with Geely, which is China’s largest private carmaker.

Ride hailing app Didi Chuxing also recently announced it would make electric vehicles designed for its services with automaker BYD.