As the incoming Biden Administration prepares to assume office and fulfill campaign promises to support significant spending in the zero emission vehicle industry—including in the construction of hundreds of thousands of electric vehicle chargers, and in the development of stringent new fuel economy and greenhouse gas emission standards for cars and trucks—it is worth considering how China may shape the overall market during the next 15 years. Indeed, on the eve of the U.S. presidential election, the State Council of the People’s Republic of China (“State Council”) issued a new 15-year development plan for its NEV—or new energy vehicle—industry.

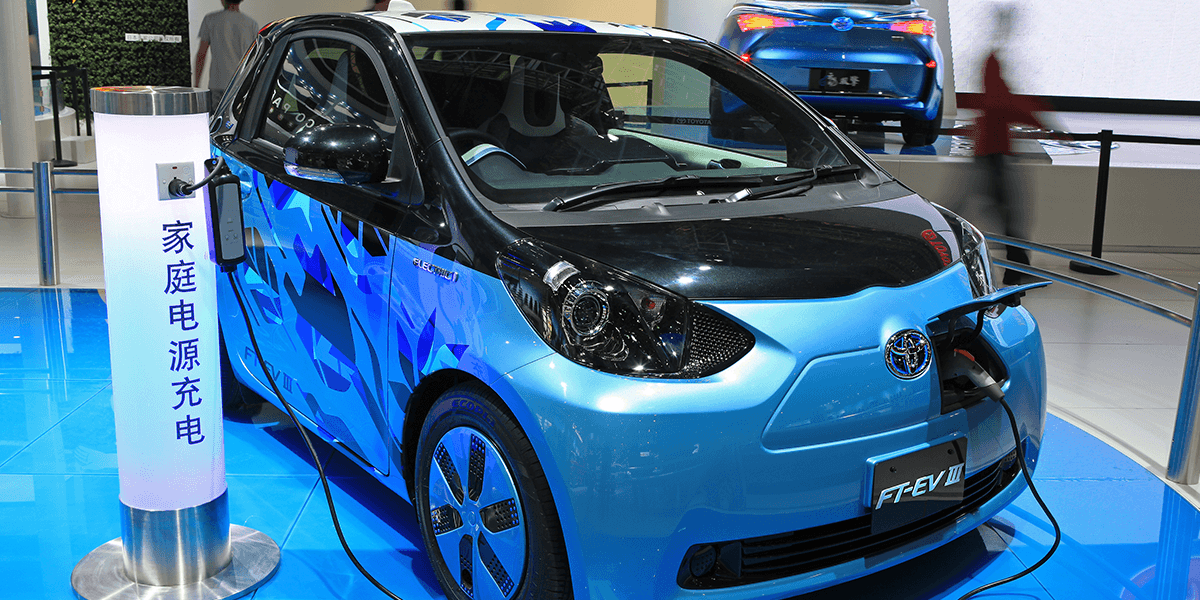

Since 2015, and for five consecutive years, China has been ranked first in the world for its NEV production and sales volume. Aiming to further enhance the competitiveness of the NEV industry, the State Council’s new Development Plan for the New Energy Vehicle Industry (2021-2035), issued on November 2, 2020, serves as a blueprint for the development of China’s battery-electric, plug-in hybrid, and fuel cell vehicle industry through 2035.

According to the Plan, by 2025, China is to achieve key technology breakthroughs in electric battery, drivetrain, and vehicle operation systems; lower the average power consumption of new pure electric vehicles to 12.0 kWh/100 km; and increase NEV sales volume to 20% of total sales of new vehicles. By 2035, China should achieve “a new international competitiveness,” building on a domestic industry capable of driving innovation and sales in zero emission vehicles on a global scale. By that time, the government aims to make pure electric vehicles mainstream in new vehicle sales, achieve full electrification of public sector vehicles, and commercialize fuel cell vehicles.

The Plan also lists four major tasks: improving technological innovation, advancing industrial integration, perfecting infrastructure construction, and deepening market openness. Specifically:

Technological Innovation: The Plan seeks to promote technological innovation through research and development (“R&D”) in six areas, referred to as the “three verticals and the three horizontals.” The term “three verticals” refers to vehicle propulsion technology—i.e., pure electric vehicles, plug-in hybrid electric (including extended range) vehicles, and fuel cell vehicles. “Three horizontals” refers to key NEV technologies necessary across each of the verticals: power battery and management systems, drive motor and power electronics, and networking and intelligent technologies. Beyond relying on market forces and incentives to drive R&D, the Plan calls for leading enterprises to carry out joint R&D projects with national laboratories. Further, R&D expenditures are to serve as a factor in evaluating the performance of state-owned enterprises.

Industrial Integration: Recognizing that advancing the NEV sector requires cooperation across several industries—i.e., the vehicle, energy, transportation, and information communication industries—the Plan urges local governments to foster enterprise clusters that integrate entire supply chains and encourage cross-industry cooperation. For instance, developing the value chain for battery technology would involve improvements in guaranteeing the supply of raw materials, advanced manufacturing equipment, and recycling systems. The Plan also highlights the importance of “vehicle-to-grid” energy interaction, the construction of smart cities, and the establishment of intelligent green logistics transportation to promote industrial integration.

Infrastructure Construction: The Plan also emphasizes the need to construct battery charging and swapping infrastructure, including fast-charging public stations: according to the Ministry of Finance, China had 4.2 million NEVs and 1.42 million charging piles by the end of September 2020. The Plan also calls for the development of hydrogen fuel technologies and the construction of infrastructure able to comprehensively provide oil, gas, hydrogen, and electricity services. Infrastructure construction goals under the Plan, among others, also touch upon the construction of intelligent highways, the formulation of NEV standards, and the establishment of cloud service platforms.

Market Openness: Having eliminated the ceiling on foreign equity shares in NEV, special purpose vehicle, and commercial vehicle companies between 2018 and 2020, the government, according to the Plan, seeks to further the development of an open, transparent, and inclusive NEV market. The Plan notes the importance of building a market-oriented, internationalized business environment characterized by the rule-of-law, equal treatment for domestic and foreign players, relaxed market access requirements, integration into global value chains, and participation in the development of international standards.

The Plan is a high-level blueprint for further government action, so its actual effect on the market will depend on how central and local government agencies implement its imperatives in the months and years to come. Subsidies will likely continue to play a critical role in the NEV industry, though they may be phased down to some extent in favor of the growing use of quotas and market-based regulatory mechanisms such as the Dual-Credit System, which requires vehicle manufacturers to meet NEV sales targets and allows automakers to trade NEV credits.

Overall, the contents of this Plan, however high-level, demonstrate Chinese industrial planners’ grand ambitions for the country’s role in the development of the global new energy vehicle industry. In addition to satisfying global demand for zero emission and low-carbon vehicles (although the Plan only briefly discusses emission reductions or vehicle efficiency), the Plan suggests that China’s domestic industry can achieve success in a global market by leading the development of new and adjacent technologies critical to the overall NEV ecosystem. After spending years promoting the manufacturing and adoption of NEVs, the Plan recognizes that autonomous driving, intelligent connected vehicles, and charging infrastructure construction will be key to achieving China’s domestic and international goals. Although a number of questions remain as to how the Chinese government will implement the details of this 15-year plan, perhaps the most urgent questions for the rest of the global auto market are: how will China treat foreign-owned players and products in its own, huge domestic market, and how will China’s efforts at home affect industry growth and competition globally?