India Lithium-ion Battery Market to Hit Market Size of USD 30,860.6 Million By 2032

Indian thium-ion battery market generated a revenue of US$ 5,116.4 Million in 2023 and is estimated to reach US$ 30,860.6 million by 2032 at a CAGR of 22.1% during the forecast period 2024–2032.

The Indian lithium-ion battery market is the lucrative place to invest and manufacture. It’s set to grow like crazy over the course of a decade. Demand for sustainable and renewable energy solutions is skyrocketing around the world. So, it’s no surprise that India is going all-in in this sector. By 2030, they their capacity will be at an incredible 220 GWh, up from a meager 20 GWh in 2022. This represents a CAGR of 50%, says India Brand Equity Foundation. At its core, this chance comes from India’s focus on building out its battery manufacturing ecosystem. From the last 2-3 years, the country us trying to reduce dependence on imports by increasing total production capabilities across the supply chain. From cell manufacturing to graphite anodes and electrolytes, they’re aiming for full independence.

The Indian government has already shown their support for the industry through initiatives like the Production Linked Incentive (PLI). It wants to build up local manufacturing capacity of 55 GWh for ACCs — with financial incentives attached to speed things along. The FAME-II schemes and recent budgetary measures also make it clear the government backs electric vehicles. In line with this, by 2030, India will need loads of raw materials for batteries as well: cathode active materials, aluminum, copper, LiPF6 electrolyte material among them.

India to Offer Golden Opportunity to Lithium-Ion Battery Manufacturers

The availability of key raw materials such as lithium, nickel, cobalt and manganese for producing active cathode materials in lithium-ion (Li-ion) batteries is limited in lithium-ion battery market. By 2030, India’s Li-ion cell manufacturing industry will need around 193,000 tons of cathode active material, 98,000 tons of anode active material, 91,000 tons of aluminum, 41,000 tons of copper and 8,000 tons of LiPF6 electrolyte material to make batteries with a total capacity of 100 GWh.

Given the present state of supply chain infrastructure — largely underdeveloped — and limited deployment expertise, it is crucial that India assert stronger control over the Li-ion battery supply chain to ensure self-reliance and security.

Energy storage systems play a crucial role in the global effort to cut carbon emissions and demand for them will explode in the coming years. As a result, the Indian government is looking to ramp up production capabilities by aggressive growth strategies not just to meet domestic needs but also because being a leader in manufacturing is essential. Securing minerals at competitive prices is key to maintaining and strengthening position in the global India lithium-ion battery market.

To support this growth, the country has also made some changes in foreign policy on strategic engagements in crucial areas. Intensive R&D (research and development), streamlining processes and emphasis on recycling initiatives are also being deployed to reduce dependence on imported components for battery cells. Educational institutions also need to develop and introduce new programs, courses and curricula aimed at equipping the workforce with necessary skillsets to thrive within this burgeoning sector. This will be vital as demand skyrockets for skilled professionals working in Li-ion battery manufacturing industries.

More than 43% Revenue of India Lithium-Ion Battery Market to Come from Electronics OEM’s

India’s lithium-ion battery market is poised to grow at a CAGR of 22.1% during 2024-2032, with the majority of this demand coming from the electronics OEM sector, according to Astute Analytica. Over 43% of revenue in this market will be derived from electronics OEMs – demonstrating just how crucial consumer tech is in driving demand for lithium-ion batteries. Some key statistics underline the growing symbiotic relationship between India’s burgeoning electronics industry and its lithium-ion battery sector:

Electronics Sales Surge: The country’s consumer electronics market is expected to expand at a CAGR of 17% during 2024-2032, thus directly influencing demand for lithium-ion batteries.

Smartphone Penetration: With more than 1.14 billion mobile-phone subscribers, smartphone penetration in India is anticipated to reach around 65% by 2025, up from the current 38%, necessitating higher output of lithium-ion batteries for power supply.

Laptop and Tablet Growth: Demand for laptops and tablets in India lithium-ion battery market has been recorded as seeing year-on-year growth of approximately 25%, further fueling need for efficient battery solutions such as those offered by Lithium-Ion Batteries.

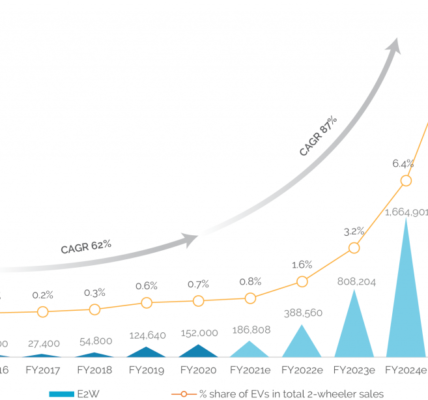

Electric Vehicle (EV) Push: In its push towards electric vehicle adoption and EV-related infrastructure development with a target of achieving 30% EV penetration by 2030, Government of India expects its domestic production capacity for high efficiency storage systems like the Lithium-Ion Batteries used in EVs to ramp up significantly; also noting that Electronics OEMs have a very important role to play in future Battery production & innovation in bid to support this national ambition.

Investment in Manufacturing: Investments into Lithium-Ion Battery manufacturing in the country are expected to exceed $3 billion by 2024.

Renewable Energy Integration: India aims to install renewable energy capacity of 170 GW by 2025. As part of this target, there is a high demand for efficient and sustainable storage solutions like Lithium-Ion Batteries which indirectly benefits the electronics sector as manufacturers look for more efficient ways to power electronic devices.

Battery Import Dependency: Currently India lithium-ion battery market imports over 85% of its Lithium-Ion Battery Requirements, however, with such strong numbers within the consumer electronics space driving demand for these batteries; analysts are optimistic that it will encourage domestic Electronics OEMs to venture into production of batteries used in their products going forward.

Consumer Electronics Dominance: Consumer electronics currently account for around 60% of total lithium-ion battery demand in India.

R&D Investment: The Research & Development spend on lithium-ion technology has been growing at an annual rate of approximately 15%, thanks to most being driven by electronics companies looking to reduce size, increase life-cycle and develop safer battery solutions.

Market Players are Actively to Looking to Invest in India’s Lithium-Ion Battery Recycling

The Indian recyclers operating in the lithium-ion battery market have been busy scaling up their capacities and addressing future demand for new batteries. A combination of government initiatives, investments into new technologies and setting up new recycling facilities are all steps towards making the battery recycling ecosystem more sustainable and efficient in India. Attero Recycling, which is India’s largest electronics recycler, plans to invest INR6bn ($72.4m) to set up its second LIB recycling plant in the country. The new plant will be based in Telangana and help increase Attero’s battery recycling capacity to 19,500 tonnes per annum (TPA) by the end of 2023 from 4,500 TPA currently. Attero aims to recycle 300,000 tonnes of lithium-ion batteries over the next five years and also aims for global expansion targeting Europe, US and Indonesia.

India lithium-ion battery market currently has a throughput capacity of 35ktpa when considering both black mass production and mineral extraction via hydrometallurgy/pyro-metallurgy. However, this needs to be scaled approximately nine times in order to meet the potential for repurposing/recycling by 2030. Players active in this space include Lohum, Exigo Ziptrax, Attero Batx Tata Chemicals LICO SungEel Hitech amongst others who are already expanding their respective capacities: Exigo is planning to expand capacity up to 200ktpa while Attero will increase its capacity from 4ktpa to 19.5 ktpa with a plant in Telangana.

The government’s involvement in this sector is crucial as it can incentivize industry to dispose responsibly or recycle products properly; policies must promote industries to inculcate recycled materials in their manufacturing process and move towards a circular economy approach. One such initiative is the Extended Producer Responsibility (EPR) mechanism, which holds electronic manufacturing company producers accountable by giving them targets for collection, disposal, and recycling of end-of-life products through an EPR credit mechanism.